Bitcoin Halving - Everything You Need To Know About The Process

In a nutshell:

- Bitcoin halving occurs when the reward for mining bitcoins is cut in half, reducing the inflation rate of Bitcoin and the rate at which new bitcoins enter circulation.

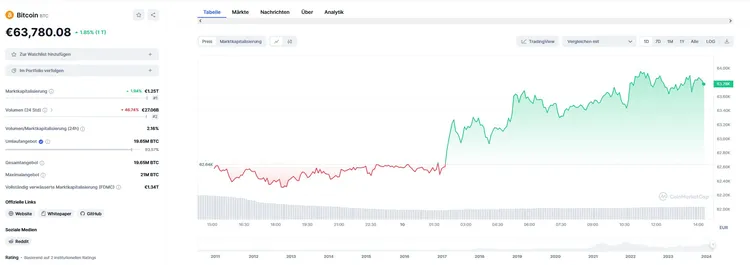

- Previous Bitcoin halvings have consistently resulted in Bitcoin's value increasing post-halving.

- The last Bitcoin halving took place on May 11, 2020, reducing the block reward for miners from 12.5 to 6.25 BTC.

- The last halving occured on April 20, 2024, cutting the reward again in half to 3.125 BTC per block.

- The fifth halving will continue to follow the four-year cycle and is therefore planned for April 2028.

What is Bitcoin Halving?

Bitcoin Halving means the halving of the mining reward in the Bitcoin network. This is one of the most important events in the Bitcoin blockchain. Because the halving causes inflation, and that in turn increases the demand for Bitcoin. The Bitcoin Halving affects everyone involved within the Bitcoin ecosystem.

A small introduction to the Bitcoin network

Now, to explain to you in more detail what actually happens in Bitcoin halving, we first need to talk a little bit about how the Bitcoin network works.

What is the Bitcoin network made up of?

The Bitcoin network is based on a technology called Blockchain. To put it simply, the blockchain consists of very, very many computers on which the Bitcoin software runs. These computers are also called Nodes.

Nodes contain a copy of all transactions ever made on the Bitcoin network. Each node is responsible for approving or rejecting a transaction on the Bitcoin network.

This means: Nodes perform lots of security checks to ensure that a transaction is valid.

After a transaction has been approved by the nodes, it is attached to the existing blockchain - becoming part of the Bitcoin network itself.

The more computers or nodes work with the Bitcoin blockchain, the more stable and secure it is. There are currently more than 10,000 nodes running the Bitcoin software.

Bitcoin Mining

Bitcoin mining is the process by which people use their computers to participate in the Bitcoin blockchain network. The people behind Bitcoin Nodes are so-called Miners. They use their computers to process and validate the transaction on the Bitcoin blockchain.

Bitcoin uses a system called Proof of Work (PoW). This means that miners have to prove that they made some effort when processing transactions to be rewarded. This effort includes the time and energy required to run the computer hardware and solve complex equations.

Basically, Bitcoin miners solve mathematical problems and thereby confirm the legitimacy of a transaction. They then add these transactions to a block and create chains of these transaction blocks, which in turn form the blockchain. When a block is filled with transactions, the miners who processed and confirmed the transactions within the block are rewarded with bitcoins.

Bitcoin Halving - detailed explanation

With this prior knowledge, we can now plunge into the main topic of this article: Bitcoin Halving.

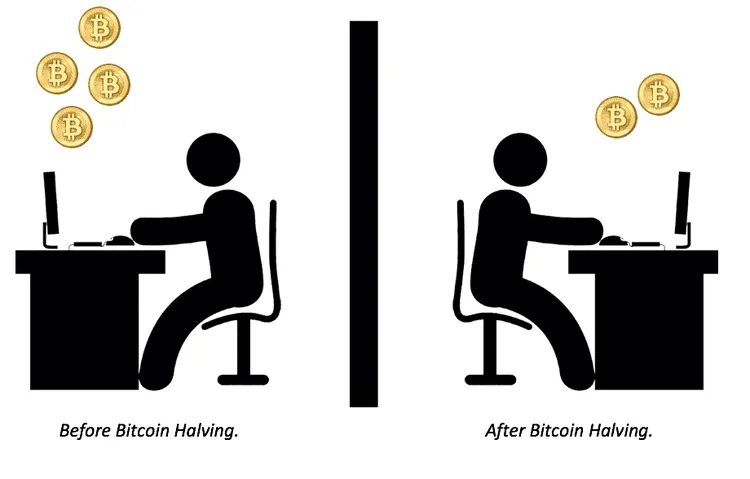

After every 210,000 blocks processed - roughly every four years - the reward Bitcoin miners receive for processing transactions is halved. This event is called a halving. Because the mining reward also halves the rate at which new bitcoins are brought into circulation. In this way, Bitcoin forces artificial price inflation.

Incidentally, this reward system for miners will only continue until around the year 2140. Because then the upper limit of 21 million Bitcoin will probably be reached. From this point on, no new bitcoins will be produced.

Instead, from then on, miners will be rewarded with fees for processing transactions, which will be paid by network users. Of course, this should ensure that miners continue to have an incentive to validate transactions and thus keep the network running.

| Halving Number | Date | Price (USD) on the Day of Halving | Block Number | Block Reward (BTC) | Halving Number |

|---|---|---|---|---|---|

| 1 | November 28, 2012 | 12.33 | 210,000 | 25 | 1 |

| 2 | July 9, 2016 | 650.63 | 420,000 | 12.5 | 2 |

| 3 | May 11, 2020 | 8,060.35 | 630,000 | 6.25 | 3 |

| 4 | April 20, 2024 | 65,303.10 | 840,000 | 3.125 | 4 |

| 5 | April 2028 | not known | 1,680,000 | 1.5625 | 5 |

The Bitcoin network is therefore approaching its finiteness. The Bitcoin Halving is important for this in that it means a decrease in the production of new Bitcoins: The maximum total number of Bitcoins is 21 million. At the end of May 2022, around 19 million bitcoins were already in circulation. This also means that there are only about 2 million bitcoins left to be released via mining rewards.

In 2009, the reward for each mined block was 50 bitcoins. After the first halving, it was 25, then 12.5, and finally 6.25 bitcoins per block from May 11, 2020.

Let's use an example here: imagine that the amount of gold that is mined from the earth is halved every four years. The value of gold increases depending on how much of it is currently on the market (supply and demand). So, in theory, halving gold production every four years would drive up the price.

The Impact of Bitcoin Halvings

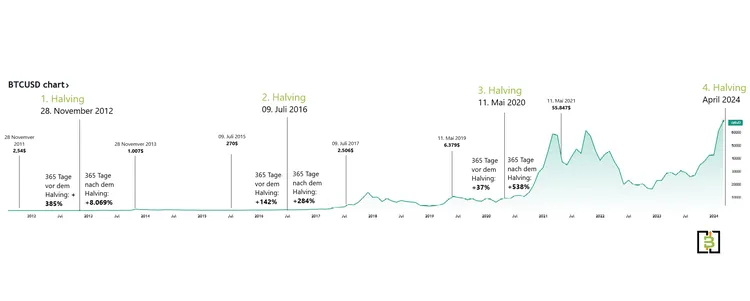

In the past, Bitcoin halvings have always been associated with massive price increases.

Before the first halving on November 28, 2012, the price of BTC was $12. One year after the halving, on November 28, 2013, the value of the coin skyrocketed to $1,007.

The second Bitcoin halving occurred on July 9, 2016. At the time of this halving, the price of BTC was $650.63. One year later, the price of a Bitcoin had surged to $2,506.

The third Bitcoin halving took place on May 11, 2020. On that day, the price of one Bitcoin was $8,060. Exactly one year later, the price of a Bitcoin had soared to $55,847, reaching its highest price up to that point.

In 2024, this trend appears to be repeating.

About six weeks before the fourth halving date, the price was approaching $70,000, surpassing its previous all-time high.

On the day of the halving (20.04.2024), the price was also close to the all-time high at over 65,000 USD.

The theory behind the halving process

The theory behind Bitcoin Halving and the chain reaction it triggers works something like this:

Reward for miners is halved → inflation halved → lower supply → higher demand → higher price

This is how the miners also benefit from Bitcoin Halving:

Now, you could, of course, ask: But what do the miners actually get from Bitcoin Halving? The reward for completing transactions is getting smaller after all!

That is correct so far. But Bitcoin has come up with an interesting solution to keep its miners (on whom the whole system is based, after all) in line:

Namely, with Bitcoin, there is a process that can be used to change the effort required to receive mining rewards. When the rewards for miners were halved, the difficulty of bitcoin mining was also reduced in the same breath.

This means that while miners still receive a smaller reward than before, the energy and time required for mining also decreases. As a result, mining is still profitable in most cases even after a Bitcoin halving.

What external factors influence Bitcoin Halving?

From 2017 to 2018, the value of a bitcoin rose to around €20,000 - only to fall back to around €3,000 a little later. A massive drop.

However, it is always a question of perspective: If you consider that the price of a Bitcoin was around €650 before halving in 2016, you can still talk about a considerable price increase.

Although this system has worked so far, bitcoin halving is usually always surrounded by immense speculation, hype and volatility.

Not only did the third halving take place during a global pandemic, but it was also accompanied by high speculation, increased interest in digital assets, and hype from quite a few celebrities.

How does Bitcoin Halving affect the Bitcoin network?

The Bitcoin Halving every four years is a massive event. It is therefore understandable that the halving has a major impact on the various parties in the Bitcoin network. We briefly summarize the consequences of Bitcoin Halving for the main players in the Bitcoin network:

Investors: The halving typically results in an up in bitcoin prices due to reduced supply and increased demand. Good news for all investors!

Miner: The effects on Bitcoin miners are a bit more complex. On the one hand, the lower Bitcoin supply increases demand and prices. Fewer rewards can also make it difficult for individual miners or small mining companies to survive in the Bitcoin ecosystem.

According to research, Bitcoin’s mining capacity is counter-cyclical to its price. So, when the price of the cryptocurrency increases, the number of miners in its ecosystem decreases and vice versa.

Bitcoin Halving 2024: Key Details of the Upcoming Halving

- Date for the last Bitcoin Halving: Tuesday, April 20, 2024.

- This was the fourth halving since the launch of Bitcoin.

- The block size for this halving was 840,000.

- The block reward was halved from 6.25 to 3.125 Bitcoin per confirmed block.

What happens when there are no more bitcoins at some point?

Around the year 2140, the cryptocurrency will have reached its upper limit of 21 million bitcoins. From then on, there will definitely be no more Bitcoin halvings, since no new coins can be mined.

However, there is still an incentive for miners to validate and confirm new transactions on the blockchain. The plan is to pay the miners in transaction fees.

Conclusion - What you should remember:

- The bitcoin halving artificially inflates the price of the cryptocurrency network, halving the rate at which new bitcoins are circulated.

- The reward system is expected to continue into 2140. Subsequently, miners are rewarded with fees for processing transactions.

- In 2009, the reward for mining each block was 50 bitcoins. After the first Bitcoin halving, it reduced to 25 bitcoins, then to 12.5 bitcoins, and further halved to 6.25 bitcoins. Starting from April 2024, the reward will be 3.125 bitcoins per block.

- The Bitcoin Halving has a significant impact on the network. Investors can expect the price to surge in the year after the halving.

- Bitcoin halving can be quite uncomfortable for miners. Due to the lower mining rewards, individual miners or small companies may drop out of the mining ecosystem.